If you prefer that we do not use this information, you may opt out of online behavioral advertising.

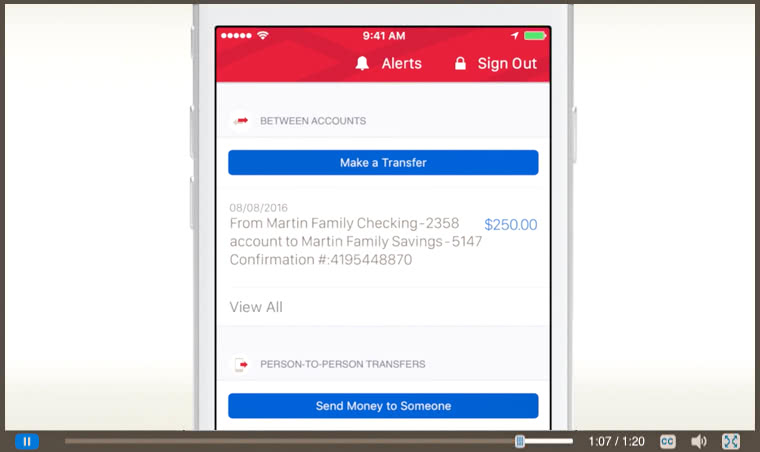

#BOA WIRE TRANSFER OFFLINE#

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. We strive to provide you with information about products and services you might find interesting and useful. The link for Account Balance History can be found just below your available balance on the Account Details screen in Online Banking. Keep in mind that Account Balance History is only available after transactions have posted to your account. Account Balance History in Business Advantage 360 would show how the $75 office supplies purchase, which was still processing, lowered your available balance to $425, which was less than the $450 check, causing an overdraft and an overdraft fee.

The $75 office supplies purchase was still processing, so it didn't post to your account on May 1.

A $450 check you wrote comes through, which would exceed your available balance by $25.You buy $75 worth of office supplies, so your available balance is now $425.You can see how processing transactions and holds impacted your available balance and the order in which transactions were posted to your account by viewing your Account Balance History in Business Advantage 360, our Small Business online banking platform. Your Account Details section in Mobile and Business Advantage 360 show transactions that posted to your account on a given day. We charge overdraft fees when a transaction exceeds your available balance. You may want to consider Balance Connect® for overdraft protection - With this optional service, we'll automatically transfer available funds from your linked backup account(s) to help cover purchases and payments or help prevent declined and returned transactions. Insights from Erica - Get valuable insights from our virtual financial assistant such as Balance Watch, which lets you know if your account balance is trending toward $0.ĭon't forget to account for checks you've written that we haven't received yet, as well as upcoming automatic payments and transactions where the final amount may change, such as when you add a tip to a restaurant charge.Alerts - Get your available balance daily, be notified when certain types of transactions (such as scheduled payments) impact your available balance during the day and more.Mobile app - Check your available balance at any time, 24/7.We have some great tools that can help you monitor your account balance and activity: The best way to avoid overdrafts is to always make sure you have enough money to cover your purchases and upcoming payments.

0 kommentar(er)

0 kommentar(er)